Insurance Tech: a buyers lens

The insurance industry is massive! It's also old. In 2019 the net premiums written for the US insurance industry amounted to over $1.3 trillion. As a share of the US GDP, it's larger than banking. When most of us think of insurance, the first few names that come to mind are probably Geico, Progressive, or State Farm. That's because just those three spend over $3 billion in ads. "Insurance" is an absurdly expensive Google AdWord.

You can primarily bucket insurance into three categories.

First, the one that is sold to employers and offered to employees as a perk.

Second, the one sold directly to an individual either as supplemental protection or as the primary coverage when not offered by an employer. Think Health, Life, Disability, etc., for gig workers; Auto, Home, and Renters insurance for everyone.

Third, the one sold to organizations to protect the organization (Cyber insurance, Liability insurance, etc.).

I'll focus on the first two buckets.

Historically, there are three key players in the insurance industry.

The insurance provider

The broker (or an agent; a broker who can only sell an insurance product from only one insurance provider)

The insured (a.k.a. the buyer)

The Problem

Let's get some of the basics out of the way.

Insurance providers operate under laws meant to protect the buyer but make money by charging a premium for products they hope most buyers either never use or overpay in premiums or coverage if they do. So obviously, they will up-sell and cross-sell products to the buyer. The house always wins! They have to for them to exist.

There are roughly 6000 insurance providers. Many of them offer multiple products. Based on their risks, tolerance for risk, and buyer classification, each product has a different premium for each buyer. I'm using buyer classification loosely to include age, zip code, age, gender, credit history, etc. The list is quite long.

This means, as a buyer, your premium will probably change by the time you've researched most of the options to get what is perfect for you. You will probably check online at a few places, make some calls, and fill out many forms. Or, in fifteen minutes or less, trust that you are getting the best rate and only buying the products you need.

You could ease the problem by offloading it to someone else. Enter brokers. Brokers take the burden of researching and calling insurance companies away from you. They work on commission, i.e., the more they sell, the more money they make. For example, Life insurance commission for agents is usually over 50% but can be as high as 80% of the first year premium. They are arguably better for the buyer in picking the right product because they spend all day with insurance. But their process is still very manual or using spreadsheets. Roughly 1.2 million are employed in broker-related jobs.

Finally, insurance products are seldom personalized to the individual. Driving on the 101 in the Bay Area should automatically increase your rate (vs. the 280), but it doesn't. Going to the gym every day should reduce your rate, but it doesn't.

So far, we've already identified five buyer-centric problems.

Knowing which insurance they need (and do not need) is hard.

The process of shopping around is very tedious.

There is a big trust gap.

Insurance products are not personalized at the individual level.

With the current tools, there aren't enough brokers in the world to solve this.

The Players

This is where companies like Policygenius, Hippo, Lemonade, and Metromile come in. They all have one goal: to help get the buyer an insurance policy while solving four to five of the above problems. There are some differences, though. Policygenius is a broker while the Hippo, Lemonade, and Metromile are agents. Policygenius and Lemonade offer multiple types of insurance, while Hippo (home) and Metromile (auto) are vertical-specific. There is one thing that all of them have in common, though. They are all tech-enabled. The space is big enough to get over $7 billion in funding in just the first half of 2021, get its own name: Insurance Tech, and its own conference: InsureTech Connect.

The Solution

The tech, at first glance, is pretty straightforward. Build a streamlined funnel experience that offers buyers the best option (right coverage at the right price), increase the number of buyers entering the funnel, and then finally optimize the flow to increase conversion. Look under the cover a little, and things get interesting.

Remember how there are over 6000 insurance providers and how they each provide many different products. These tech-enabled companies build integrations to many of these products so that the buyer only has to provide information once. These integrations aren't always the easiest, especially if you are a broker working with multiple insurance providers who seldom have APIs that developers can use. Some of the new insurance-tech companies are changing that. Lemonade provides APIs, however, only to their underlying insurance company (which makes sense since they are agents). There are also some API-only companies building Insurance-API across multiple providers. Regardless, integrations end up being a moat (for now) against new entrants and are a big part of insurance tech companies.

As they convert more buyers, they build more and more granular user profiles of their buyers. These companies then apply Machine Learning models to connect buyers to better insurance products and connect better buyers to insurance providers. Since most insurance providers have their own risk tolerance profiles, I imagine the insurance providers will be more than willing to pay for even the slightest tweaks in the matching/pricing models. Insurance-tech companies are still able to stay buyer-focused. They only recommend the level and type of insurance product the buyer needs at the time. And then remind the buyer about adjustments as their needs change. Imagine building a roadmap for their buyers and doing it at scale.

Insurance is starting to sound a lot like the credit industry. Replace just one word in the tagline for CreditKarma (a company acquired for over $8 billion) "Financial products for every step of your journey," and it fits everything I just covered. In fact, insurance companies also have a lesser know score called "insurance score" for you. A lot of the tech solutions also overlap.

Finally, insurance tech companies further personalize insurance to the individual buyer in various ways using IoT devices. These include pay-per-use like per-mile for auto, discounts for good behavior like safe driving and daily fitness, and discounts for installing smart devices that reduce the risk of high-cost claims like smart water leak detection, smart fire detectors, door open-close detection sensors, etc.

So the tech-enabled solutions to the buyer problems include:

Integrating with insurance providers.

Unifying various products via APIs.

Optimizing buyer experience.

Building granular bi-directionally useful user profiles.

Personalizing

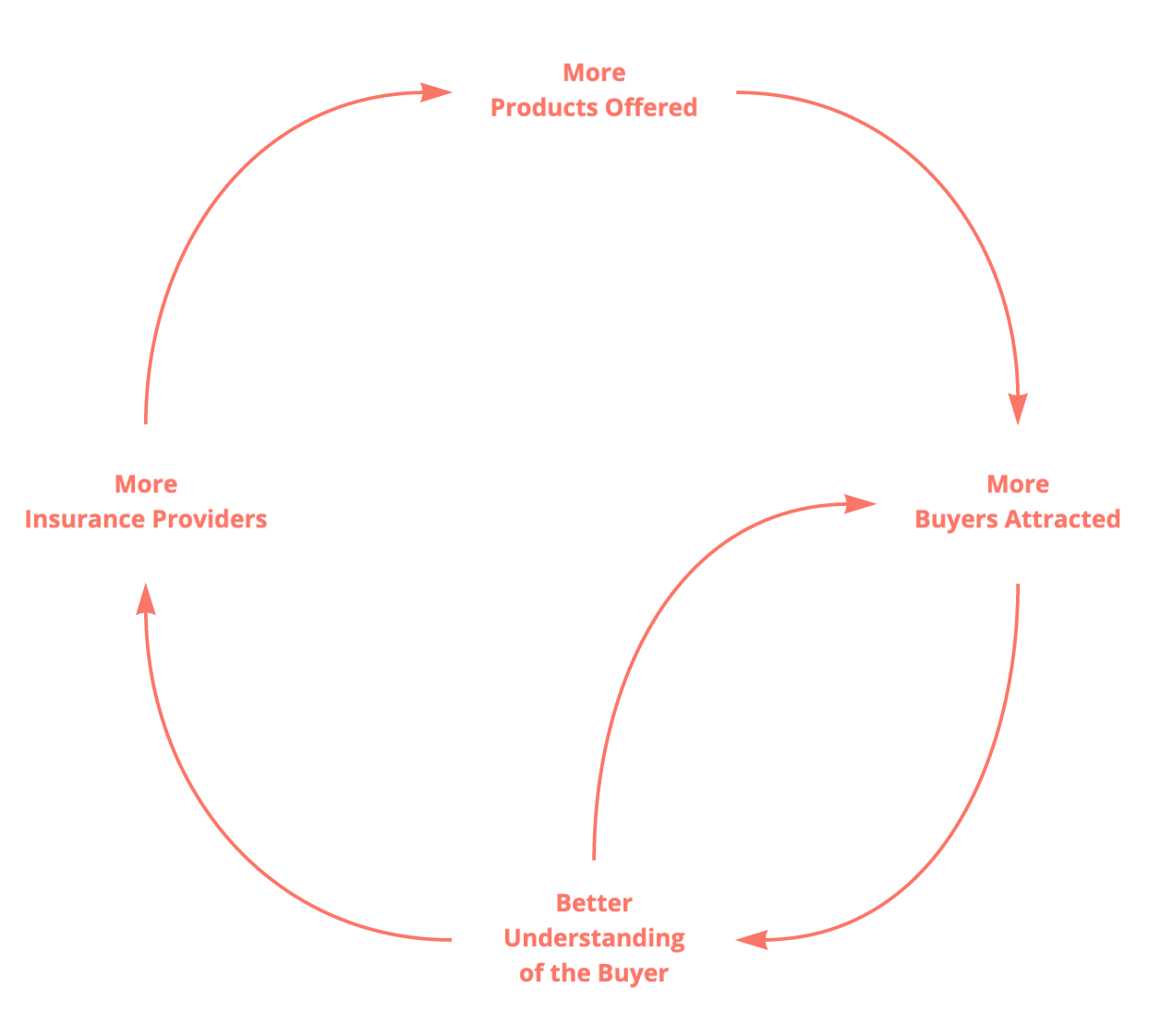

This gives Insurance-tech companies an incredible fly-wheel effect.

In summary, a big trillion-dollar traditionally boring space with interesting problems and an effective flywheel. In my experience, that usually results in big disruptions.